US Legal Retirement Age: Navigating Social Security, Medicare, and Workplace Realities

Author Name: Nahyan | uslawguide

Last Updated: July 2, 2025

Social Security Retirement Age: The Cornerstone of US Retirement

The Social Security Administration (SSA) defines several key ages related to retirement benefits, which are determined by your birth year. These ages dictate when you can start receiving your earned benefits and at what percentage.

1. Full Retirement Age (FRA)

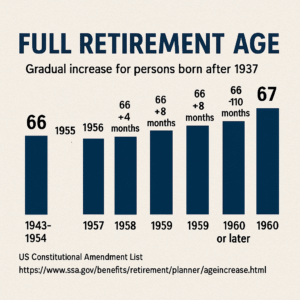

Your Full Retirement Age (FRA), sometimes called “Normal Retirement Age,” is the age at which you are entitled to receive 100% of your Primary Insurance Amount (PIA), which is the full monthly benefit calculated based on your earnings history. The FRA has been gradually increasing for those born after 1937, reflecting legislative adjustments to ensure the long-term solvency of the Social Security program. For broader legal context on how constitutional changes influence policy, visit US Constitutional Amendment List. You can also verify the current FRA guidelines directly from the Social Security Administration at:Here.

(Note: If your birthday is on January 1, the SSA calculates your benefit as if your birthday was in the previous month, affecting your FRA slightly.)

2. Early Retirement Age

You can start receiving Social Security retirement benefits as early as age 62. However, if you claim benefits before your FRA, your monthly benefit amount will be permanently reduced. The reduction is significant: if your FRA is 67, claiming at age 62 results in a permanent 30% reduction in your monthly benefit. The exact percentage reduction depends on how many months you claim early.

3. Delayed Retirement Credits

Conversely, if you delay claiming Social Security benefits beyond your FRA, you can earn delayed retirement credits. Your monthly benefit amount will increase for each month you delay, up to age 70. After age 70, there is no further increase in benefits for delaying, so there is no financial incentive to wait longer. These credits can significantly boost your monthly payment, approximately 8% per year beyond your FRA.

Factors Influencing Social Security Age Adjustments

The adjustments to the Social Security FRA are primarily a response to:

- Increased Life Expectancy: People are living longer, meaning they draw benefits for more years.

- Demographics: Changes in birth rates and workforce participation impact the worker-to-retiree ratio, which funds the system.

- Program Solvency: Adjustments are made to help ensure the long-term financial health of the Social Security trust funds.

Medicare Eligibility Age

Unlike Social Security, eligibility for Medicare, the federal health insurance program for seniors and certain disabled individuals, is generally a fixed age for most people.

- Age 65: Most U.S. citizens and legal permanent residents who have resided in the U.S. for at least five continuous years become eligible for Medicare when they turn 65. This eligibility applies regardless of when you choose to claim your Social Security retirement benefits.

- Earlier Eligibility: Individuals younger than 65 may also be eligible for Medicare if they have certain disabilities (after 24 months of receiving Social Security Disability Insurance benefits), End-Stage Renal Disease (ESRD), or Amyotrophic Lateral Sclerosis (ALS).

It’s critical to enroll in Medicare on time (typically during the Initial Enrollment Period, which begins three months before your 65th birthday, includes your birthday month, and extends three months after) to avoid potential penalties and ensure continuous health coverage.

Common Workplace Retirement Age and Mandatory Retirement

For the vast majority of occupations in the United States, there is no mandatory retirement age imposed by federal law. The Age Discrimination in Employment Act (ADEA) of 1967 generally prohibits discrimination against individuals aged 40 or older, including requiring them to retire at a certain age. This means most employees can continue working as long as they are able and competent, and their employer has a need for their services.

However, there are very limited exceptions where mandatory retirement ages exist, primarily for safety-sensitive professions or certain executive roles:

- Airline Pilots: Commercial airline pilots generally have a mandatory retirement age of 65.

- Air Traffic Controllers: Typically have a mandatory retirement age of 56, with some exceptions.

- Certain Federal Law Enforcement Officers and Firefighters: Often have mandatory retirement ages, typically around 57, after a certain number of years of service.

- Foreign Service Officers: Mandatory retirement at age 65 for career members.

- High-Level Executives: A narrow exception allows for mandatory retirement for certain bona fide executives or high-policymaking employees who are at least 65 and are entitled to a substantial annual retirement benefit.

- Judges: Some state judicial systems have mandatory retirement ages for judges (e.g., 70 or 75).

For employer-sponsored retirement plans (like 401(k)s or pensions), a “normal retirement age” is often defined (e.g., age 65), but this typically refers to the age at which an employee can retire and receive full benefits from that specific plan, not a mandatory cessation of employment. Many plans also offer “early retirement” options at younger ages, often with reduced benefits.

Personal Retirement Age: Beyond the Legal Minimums

While federal laws and employer plans define certain “legal” or “normal” retirement ages, an individual’s actual retirement age is largely a personal financial and life decision. Factors that heavily influence when someone truly retires include:

- Financial Readiness: Having sufficient savings, investments, and other income streams (beyond Social Security) to support one’s desired lifestyle in retirement.

- Health: Personal health status and access to affordable healthcare are significant considerations.

- Debt Levels: High levels of debt (mortgage, student loans, credit card debt) can necessitate working longer.

- Lifestyle Expectations: The cost of living in retirement, travel plans, hobbies, and leisure activities all play a role.

- Employer Benefits: Continuation of health insurance, pension vesting, or other benefits can influence the decision.

- Desire to Work: Many individuals choose to continue working part-time or full-time for personal fulfillment, social engagement, or to maintain skills, even after becoming eligible for benefits.

Impact of Changing Retirement Ages

The ongoing discussion and gradual increases in Social Security’s Full Retirement Age have several implications:

- Longer Working Careers: Many individuals may need or choose to work longer to maximize their Social Security benefits or ensure financial security.

- Workforce Dynamics: A growing population of older workers can impact labor markets, including opportunities for younger workers.

- Healthcare Costs: Longer lifespans and later retirement can place different demands on healthcare systems.

- Intergenerational Equity: Debates often arise about fairness across different generations regarding the funding and benefits of social programs.

Conclusion

The concept of US legal retirement age is primarily driven by eligibility for crucial federal benefits like Social Security and Medicare. While age 62 marks the earliest eligibility for reduced Social Security benefits and age 65 for Medicare, the Full Retirement Age for Social Security is gradually shifting, reaching 67 for those born in 1960 or later. Critically, for the vast majority of the American workforce, there is no mandatory retirement age, allowing individuals to work as long as they choose and are able. Understanding these nuanced “legal” ages is a foundational step in effective personal retirement planning, enabling individuals to make informed decisions about their financial future and well-being.

Frequently Asked Questions About US Legal Retirement Age

Q: Can I collect Social Security and still work? A: Yes, you can. However, if you are under your Full Retirement Age and earn above certain annual limits, your Social Security benefits may be temporarily reduced or withheld. Once you reach your Full Retirement Age, your benefits are no longer subject to these earnings limits, and you can work and earn any amount without your Social Security benefits being reduced.

Q: Do I automatically get Medicare when I turn 65? A: If you are already receiving Social Security retirement benefits at least four months before you turn 65, you will typically be automatically enrolled in Medicare Parts A and B. If you are not yet receiving Social Security benefits, you will need to actively enroll in Medicare when you turn 65. It’s advisable to do so during your Initial Enrollment Period (starting three months before your 65th birthday) to avoid potential late enrollment penalties.

Q: Are there any jobs in the US that have a mandatory retirement age? A: Yes, but they are very few. Mandatory retirement ages typically apply to certain safety-sensitive professions, such as commercial airline pilots (age 65) and air traffic controllers (age 56), and some specific federal law enforcement, firefighter, and Foreign Service roles. For most other jobs, the Age Discrimination in Employment Act (ADEA) prohibits mandatory retirement.

Q: If I delay taking Social Security, how much more will I get? A: For each year you delay claiming Social Security benefits past your Full Retirement Age, up to age 70, your monthly benefit will increase by a certain percentage (currently 8% per year for those with an FRA of 66 or 67). This is known as delayed retirement credits. After age 70, there’s no further increase for delaying.

Q: What is the “early retirement age” for Social Security? A: The earliest age you can begin receiving Social Security retirement benefits is age 62. However, claiming at this age (or any age before your Full Retirement Age) results in a permanent reduction in your monthly benefit amount.

Responsible Disclaimer: This article provides general information about US legal retirement age and related federal benefits. It is not intended as financial or legal advice. Retirement planning is complex and highly individualized. For personalized advice, readers should consult with a qualified financial advisor, tax professional, or the official Social Security Administration (SSA) and Medicare websites.